CBI Netbanking Login: Central Bank of India (CBI) is the property of the nation and country’s assets as proclaimed by sir Sorabji Pochkhanawala who established the bank in 1911. The bank plays an active role in the key areas of agriculture, small, medium, and large-scale industries. In addition, the bank introduces several employment schemes to generate employment and improvise the economies.

The bank is truly public sector in nature, and the Central Bank of India has a network spread in 28 states and further have branches in 7 Union territories. Across the nation, there are 4594 branches, one extension counter, and 10 satellite offices by June 2021. Central Bank of India has a wide range of services for customers and major corporate clients happen to be their clients’. They are ICICI, IDBI, UTI, LIC, and HDFC.

CBI Netbanking Login, Central bank of India IFSC Code Details:

CBI Net Banking Services:

The Central Bank of India provides its customers with a bundle of net banking services. They can be described as account balance status, cheque status inquiry, transaction history. The customers opting for net banking services can make an instant download account statement, fund transfer to self-accounts.

In addition, a net service subscriber can perform fund transfers to third-party accounts, stop cheque payments. A new customer can open accounts online, make year-end tax payments, and bill payments, etc. With ample benefits for its customers, it shall be helpful to readers if they come to know the procedure of registration, login procedures to avail the benefits as mentioned in the paragraph.

Registration Process for Net Banking:

1st step: Open the CBI portal i.e. https://www.centralbank.net.in/jsp/Register.htm

2nd Step: The customer should fill in the form and make a submission of it at the customer’s branch.

3rd Step: The bank begins to scrutinize the details of the submitted form before issuing the net banking service activation.

4th Step: The CBI bank will send the login Credentials like Passwords to the customer’s address.

5th Step: The customer must visit the concerned bank and collect the User ID once the passwords are obtained through the postal/courier delivery system.

6th Step: The customer must use the three entities as are user id, login password, and the transaction password to activate the net banking

7th Step: User ID, login password, and the transaction password are then used to activate net banking.

CBI NetBanking Login Process:

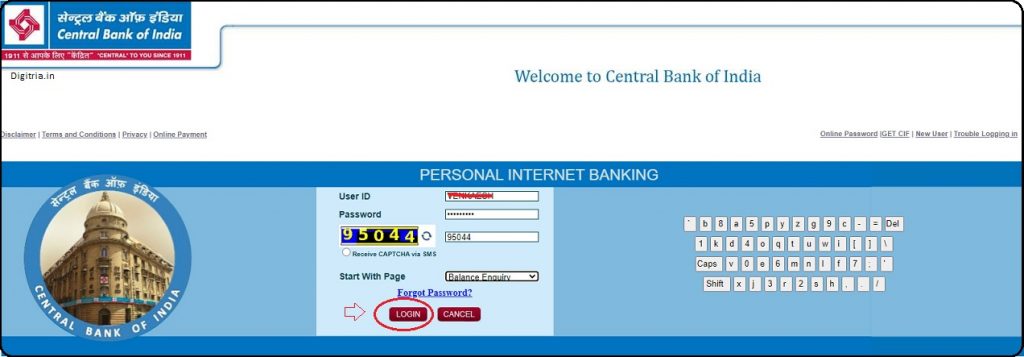

After activation of the logins, the customer must enter the CBI net banking login portal and while entering the logins it is always advisable to use a virtual keyboard. When operating the net banking system, the customer must avoid a shared computer for security reasons.

1st step: Visit the web portal at https://centralbank.net.in/servlet/ibs.servlets.IBSLoginServlet.

2nd Step: The customer should enter the User ID, login password, and click on the Login Option.

Also Check: Federal Bank Net Banking Login

NEFT/RTGS: Net Banking Transactions:

The central bank of India has two important transaction types NEFT, and RTGS. The bank lays transaction charges that are easily affordable to their net banking customers. The transaction charges that are applicable for the NEFT/RTGS services are as follows.

NEFT CBI Net Banking Transaction Charges:

The CBI Netbanking transactions are categorized based on the transacting amounts. The charges applicable are dependent on the transacting amounts. The Complete details are listed below.

For NEFT:

| Type of Transaction | Charges |

| up to 10,000/- | INR 2.50 |

| INR 10,000 to INR 1, 00,000 | INR 5.0 |

| INR 1,00,000 to INR 2,00,000 | INR 15.0 |

| Above INR 2,00,000 | INR 25.00 |

RTGS CBI Net Banking Transaction Charges:

Likewise, for RTGS (from INR 2,00,000 to INR 5,00,000) the bank charges in two levels depending on the chosen time for service, i.e., from 8 am to 11 am the service charge is INR 25.00, and then from 11.00 am to 01:00 pm the service charge is INR 27.00, from 1:00 pm to 4:30 pm the service charge is INR 30.00. For transactions above INR 5,00,000, the charges that are applicable vary according to the time. Any time between (8:00 am to 11:00 am, INR 50.00), (11:00 am to 1:00 pm, INR 50.00), (1:00 pm to 4:30 pm, INR 55.00), (After 4:30 pm, INR 55.00).

Net Banking Services Aren’t So Risky!

It is quite evident that net banking customers make use of login credentials and if they are hacked then those customers shall lose their entire money from their savings. Although the security system adopted by the Central Bank of India is safe and secure here is a piece of advice for their net banking customers.

1. Whenever the banker issues a password, it must be instantly changed to maintain the secrecy of the password.

2. For the net banking service, the user must maintain antivirus in the system and continue it should be updated.

3. The net banking customer must track the transaction history of the operating accounts.

4. The net customers are advised never to share their login credentials with others and let sensitive information over emails.

5. The customers should never download any software or file without learning the details as it may cause harm to the system or affect net banking.

6. The customers must log out from the net banking account immediately after completion of the work.

7. It is a word of caution that net banking users must avoid the use of public workstations.

Also Read: BOB Netbanking Login